How Can You Make Money With Forex Trading

I'm sure you want to know how much money can you make from forex trading, right?

After all…

You've heard of traders making millions in the financial markets.

But here's the thing:

You can't compare yourself to them.

Why?

Because you've got different account size, risk appetite, risk management, trading strategy, and etc.

If you do so, it's like comparing an apple with an orange (it's silly).

That's why I've written today's post to explain how much money can you make from forex trading — with objective measures.

No more second guesses. No more ridiculous projections. No more illusions.

Just statistics, numbers, and the cold hard truth.

Ready?

Then let's begin…

(Or if you prefer, you can watch this training below…)

The most important metric in your trading career

Here's the thing:

You can have a 1 to 2 risk to reward on your trades. But if you only win 20% of the time, you will be a consistent loser.

Now obviously your risk to reward isn't the answer. Then what is? Your win rate?

Let's see…

Perhaps you have a 90% win rate. But if you lose $0.95 for every dollar you risk, you will also be a consistent loser.

So, what's the solution?

Clearly, your risk to reward and win rate are meaningless on its own.

Well, the secret is this…

…you must combine both your win rate and risk to reward to determine your profitability in the long run.

And this is known as your expectancy.

Your expectancy will give you an expected return on every dollar you risk.

Mathematically it can be expressed as:

E= [1+ (W/L)] x P – 1

Where:

W means the size of your average wins

L means the size of your average loss

P means winning rate

Here's an example:

You have made 10 trades. 6 were winning trades and 4 were losing trades. That means your percentage win ratio is 6/10 or 60%. If your six trades brought you a profit of $3,000, then your average win is $3,000/6 = $500. If your losses were only $1,600, then your average loss is $1,600/4 = $400.

Next, apply these figures to the expectancy formula:

E= [1+ (500/400)] x 0.6 – 1 = 0.35 or 35%.

In this example, the expectancy of your trading strategy is 35% (a positive expectancy). This means your trading strategy will return 35 cents for every dollar traded over the long term.

Let's move on…

Why you must play more to WIN more

Have you realized this?

The majority of casinos operate 24 hours a day, 365 days a year. Why?

Because the more they play, the more they make — and it's the same for trading.

You're might wonder:

"How does this relate to trading?"

This means the frequency of your trades matter. The more trades you put on, the more money you'll make (albeit having a positive expectancy).

Imagine this:

You have a forex trading strategy that wins 70% of the time, with an average of 1 to 3 risk to reward.

But here's the thing…

…it only has 2 trading signals a year.

How much money can you make from this forex trading strategy?

Not a lot, right? Heck, you might even lose in that year since there's a 9% chance of losing two trades in a row.

Can you see how important this is?

Now:

The frequency of your trades is important but it's not enough to determine how much money you can make in forex trading.

There are still a few more factors that play a major role. Read on…

Why money is the lifeblood of your Forex trading business

You've probably heard of stories where a trader took a small account and trade it into millions within a short while.

But what you don't hear is that for every trader that attempts it, thousands of other traders blow up their account.

So…

Let's not treat trading as get a rich quick scheme. Instead, treat it as a business you're looking to grow it steadily over time.

Now, let's say you can generate 20% a year (on average).

With a $1000 account, you're looking at an average of $200 per year.

On a $1m account, you're looking at an average of $200,000 per year.

On a $10m account, you're looking at an average of $2,000,000 per year.

This is the same strategy, same risk management, and same trader.

The only difference is the capital of your trading account.

Can you see my point?

Now…

That's not to say you can only make 20% a year because, for a day or swing traders, the percentage could be higher (as you have more trading opportunities).

But no matter what strategy or system you're using…

…the bottom line is you need money to make money in this business, period.

Why your bet size determines how much you can make

You've probably heard this before…

"The bigger you risk, the higher your returns."

So is this true?

Well, yes and no.

Here's why I said yes…

Let's say your trading strategy has a positive expectancy and generates a return of 20R per year. Also, you have a decent size $100,000 trading account.

So, how much can you make from your trading?

Well, this depends on how much you're risking per trade.

If you risk $1000, then you can make an average of $20,000 per year.

If you risk $3000, then you can make an average of $60,000 per year.

If you risk $5000, then you can make an average of $100,000 per year.

This is the same strategy, same account size, and same trader.

The only difference is your bet size (or risk per trade). The bigger you risk, the higher your returns.

Now…

Here's why I said no…

If your bet size is too large, the risk of ruin becomes a possibility. This means you have a higher risk of blowing up your trading account — and it reduces your expected value.

If you want to understand the math behind it, go read this risk management article by Ed Seykota.

Moving on…

Do you withdraw or compound your returns?

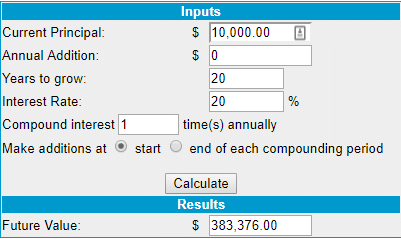

If you make an average of 20% a year with a $10,000 account, after 20 years it will be worth… $383,376.00.

But what if you withdraw 50% of your profits each year?

This means you will make an average of 10% a year and after 20 years your account will be worth… $67,275.00.

Now clearly, compounding your returns will generate the highest return.

But whether it's feasible or not depends on how you manage your trading business.

Here's why…

If you're a day-trader, then chances are trading is your only source of income. You have to withdraw from your account to meet your living needs.

But if you have a full-time job and you're trading on the sides, then you don't have to make any withdrawals and can compound the returns in your account.

Now…

There's no right or wrong to this. Ultimately, you must know what you want out of your trading business — and understand how withdrawals will affect your returns over time.

So, how much money can you make from Forex Trading?

Now…

You've learned the key factors that determine how much money can you make from forex trading.

Next, let's see how to use this knowledge and calculate your potential earnings.

Here's an example:

Trading expectancy – 0.2 (or 20%)

Trading frequency – 200 trades per year

Account size – $10,000

Bet size – $100

Withdrawal – None

Once you know your numbers, plug and play them into this formula…

Trading expectancy * Trade frequency * Bet size

And you get:

0.2 * 200 * $100 = $4000

This means you can expect to make an average of $4000 a year (with the above metrics).

Now if you want to convert to percentage terms, then use this modified formula…

[Trading expectancy * Trade frequency * Bet size] / Account size

And you get:

[0.2 * 200 * $100]/$10,000 = 40%

This means you can expect to make an average of 40% a year.

How much do you need to get started on Forex Trading?

While there are brokers which don't need you to deposit a minimum amount to get started with Forex trading…

I usually recommend newbies to start with at least $500.

I'll explain.

This is how the math works out (on most brokers):

- Minimum size is 1 micro-lot: 1,000 units

- Transaction cost: Average 3 pips (which is about 30 cents)

Now let's take for example:

You want to go long on 1,000 units of EUR/USD.

And your trade requires a stop loss of 50 pips.

Since each pip is worth 10 cents, this equates to a risk of $5.

After adding transaction cost, your total risk is $5 + 30 cents = $5.30

(Notice that the transaction cost also takes up a fraction of your risk per trade.)

Now imagine if you start with only $100.

What happens?

Your risk per trade easily becomes more than 5%!

So by starting with at least $500…

You'll keep your risk per trade constant – at 1 to 2% each.

Alright so far?

Then let's move on…

Bonus: How to massively increase your returns using the 9th wonder of the world

At this point:

You've learned the formula to calculate how much you can earn from forex trading.

Now, you'll learn a simple tip to help you massively increase your earnings without increasing your risk.

I call it the 9th wonder of the world.

Here's how it works…

Instead of only compounding your returns over time, you also add funds to your trading account regularly — and compound it.

Let me prove it to you…

Here's an example:

If you have a $10,000 account and you earn an average of 20% a year.

After 20 years, you have… $383,376.

Not too shabby.

What but if you add funds to your account every year?

Let's see…

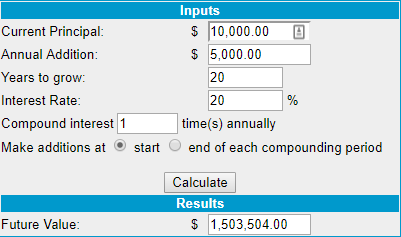

If you have a $10,000 account earning an average of 20% a year, and you add $5000 to your account every year.

After 20 years, you have… $1,503,504.

Now we're talking!

Can you see how powerful this is?

Summary

So, how much money can you make from forex trading?

Well, there's no one factor that determines how much money you can make in forex trading.

Instead, you must look at these 5 metrics:

- Trading expectancy

- Trading frequency

- Account size

- Bet size

- Withdrawals

Then apply this formula… Trading expectancy * Trade frequency * Bet size

And you'll have an objective measure of how much money you can make in forex trading.

Now, here's my question for you…

How much do you expect to make from forex trading?

Leave a comment below and let me know.

How Can You Make Money With Forex Trading

Source: https://www.tradingwithrayner.com/how-much-money-can-you-make-from-forex-trading/

Posted by: savoiecapand.blogspot.com

0 Response to "How Can You Make Money With Forex Trading"

Post a Comment